Northern Irish consumers to pay Republic’s higher VAT - prices to rise

The hidden costs of Boris’s Withdrawal Agreement for the UK’s Northern Irish citizens

© Brexit Facts4EU.Org.

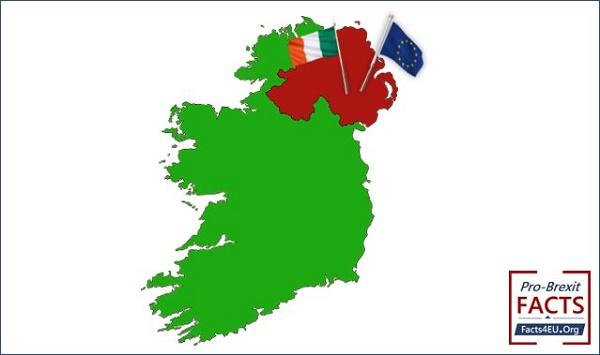

Part of the UK will come under EU rules and the Republic of Ireland’s VAT regime

In a shock revelation from a House of Commons official Briefing Paper, citizens of Northern Ireland will be expected to pay higher prices for everyday goods and services, as a result of Boris Johnson’s new EU Withdrawal Treaty.

Brexit Facts4EU.Org Summary

Northern Ireland set to align with Republic’s higher VAT rates

What the Government and the EU are planning for the citizens of Northern Ireland

The new Withdrawal Treaty is vague on many issues in relation to Northern Ireland which will seemingly be left to negotiation during the Transition Period.

Brexit Facts4EU.Org therefore turned to the House of Commons Library Service for information on the Government’s and the EU’s intentions. The Commons’ official researchers are located in the seat of power itself and their reports are generally treated as gospel by most MPs.

In its Briefing Paper on the Withdrawal Agreement, the Commons Library Service says:-

“Northern Ireland will still be in the UK's customs territory and VAT area,

however the region will align with the EU's rules in these areas.”

As we correctly reported last week, the report goes on to say that “Only two Articles in the main Withdrawal Agreement have changed from the November 2018 text, and the changes are minor. This means that the rest of the Agreement remains the same.”

The most significant changes to the Protocol are in four main areas: Customs, VAT, Democratic consent, and the ‘level playing field’. The report goes on to say:-

“In legal terms, Northern Ireland remains part of the UK customs territory. Northern Ireland will be included in UK free trade agreements.

“In practice, however, Northern Ireland will apply many EU customs rules and there will effectively be a customs and regulatory border between Great Britain and Northern Ireland in the Irish Sea.

“The new arrangements are permanent, provided consent is given. They are no longer a ‘backstop’ – i.e. an insurance policy which will only come in effect if other measures fail to keep the Irish border open.”

Energy and other prices are set to rise significantly

Perhaps one of the most shocking aspects of this official report arise from its comments on the VAT regime to be applied in Northern Ireland.

“Initially it was proposed that Northern Ireland would be treated as part of the UK for VAT purposes, entirely outside the scope of EU VAT law. It is now anticipated that EU VAT rules for goods would apply in Northern Ireland to avoid the creation of a hard border, although the UK would continue to collect receipts from both VAT and excise duty.

“In addition, it is proposed that the VAT base and VAT rates in Northern Ireland could be amended, to be aligned with the VAT system in Ireland. This would maintain a level playing field.”

In effect, this would mean that energy prices in particular are set to soar, with Northern Irish households having to pay over two-and-a half times the amount of VAT on the supply of electricity, oil, gas and coal. The UK rate is 5% whilst the Republic of Ireland’s rate is 13.5%.

Northern Irish consumers will also see the standard rate of VAT on the majority of goods rise from the UK’s 20% to the Irish Republic’s 23%.

Observations

We are not tax accountants. For now we have only looked at some basics and have compared the published VAT rates in the UK and in Ireland.

When the above information is widely known it is certain that the major accountancy firms in Northern Ireland will be all over this. We are sure that the press in Northern Ireland, as well as the DUP and other political parties, will be asking serious questions of the UK and Irish Governments, as well as of the EU itself.

If the House of Commons official Briefing Paper is correct, then we expect a furore.

Aside from the specifics of price hikes, there is also the question of principle. The report makes it clear that Northern Ireland will be treated as a different country in many ways. If the Government continues to promote its Withdrawal Treaty, it is tacitly saying that it accepts a partial break-up of the United Kingdom.

We welcome readers’ comments as ever, in the Comments Section below. Please note that you can write and then click to review what you’ve written, but you must then click again to submit your comment if you want others to see it.

Finally, if you want us to keep researching and publishing original material daily, seven days-a-week, we need your help. We do not have coporate sponsors – we rely on individual readers sending donations. You can do this quickly and securely using the methods below this article. Thank you.

[ Sources: House of Commons Library | HMRC | Irish Revenue Commissioners ] Politicians and journalists can contact us for details, as ever.

Brexit Facts4EU.Org, 25 Oct 2019

Click here to go to our news headlines

And please scroll down to COMMENT on the above article.

Since before the EU Referendum, Brexit Facts4EU.Org

has been the most prolific researcher and publisher of Brexit facts in the world.

Supported by MPs, MEPs, & other groups, our work has impact.

We think facts matter. Please donate today, so that we can continue to ensure a clean Brexit is finally delivered.

Paypal Users Only - Choose amount first

Quick One-off

Monthly

Something to say about this? Scroll down for reader comments