Ireland makes more than twice as much GDP per capita as EU average

Facts4EU asks “So why aren’t the Irish all driving around in Bentley convertibles?”

Montage © Facts4EU.Org 2023

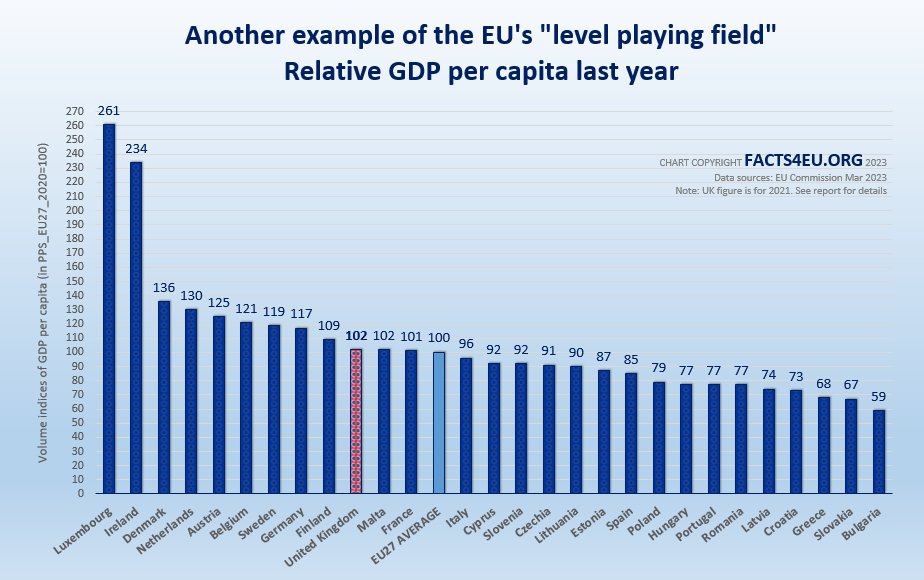

EU’s latest GDP per person numbers show huge disparity across the bloc

In the latest EU figures published last week for 2022, GDP per capita expressed in purchasing power standards (PPS) put Ireland in second place in the table, with its GDP per person being more than twice (+134%) the EU27’s average.

The figures for the 27 countries ranged from a low of 59% of the EU average in Bulgaria to a high of 261% in Luxembourg and showed a huge disparity across the bloc.

Brexit Facts4EU.Org Summary

GDP per capita expressed in purchasing power standards

Index : EU average=100

- Luxembourg : 261

- Ireland : 234

- Denmark : 136

- Netherlands : 130

- Austria : 125

- Belgium : 121

- Sweden : 119

- Germany : 117

- Finland : 109

- United Kingdom : 1021

- Malta : 102

- France : 101

- EU27 AVERAGE : 100

[Source: EU Commission’s statistics agency (Eurostat), 23 Mar 2023. 1Note: Eurostat's information only shows the UK's number for 2021.]

© Brexit Facts4EU.Org 2023 - click to enlarge

The vertiginous slope in the EU’s ‘Level Playing Field’

The front runners Luxembourg and Ireland were followed at a distance by Denmark (36% above the EU average), the Netherlands (+30%), Austria (+25%), Belgium (+21%), Sweden (+19%) and Germany (+17%).

In contrast, Bulgaria (41% below the EU average), Slovakia (33%) and Greece (32%) registered the lowest Gross Domestic Product per capita.

Why Ireland? Why Luxembourg?

Ireland: The high level of GDP per capita in Ireland can be mostly explained by the presence of large multinational companies holding intellectual property. The associated contract manufacturing with these assets contributes to GDP, while a large part of the income earned from this production is returned to the companies’ ultimate owners abroad.

Ireland has been successful in attracting companies such as Google as a result of it having the lowest rate of corporation tax (12.5%) in the EU. This contrasts with the UK’s rate which has just been increased from 19% to 25% by the Sunak-Hunt government.

Luxembourg: The high GDP per capita in Luxembourg is partly due to the country's large share of cross-border workers in total employment. While contributing to GDP, these workers are not taken into consideration as part of the resident population which is used to calculate GDP per capita.

How these things are measured

In international comparisons of national accounts data, like GDP per capita, it is desirable not only to express the figures in a common currency, but also to adjust for differences in price levels. Failing to do so would result in an overestimation of GDP levels for countries with high price levels, relative to countries with low price levels.

Once this adjustment is made even the EU Commission’s own statistics body is forced to admit :

“The dispersion in GDP per capita across the EU Member States is quite remarkable.”

- Eurostat, 23 Mar 2023

Observations

The reason the Irish aren’t all driving around in Bentley convertibles

Ireland’s GDP per capita is flattered by the presence of multinational companies using the country as their tax base in Europe. This has a major benefit to the Irish government in terms of its total revenue from corporation tax.

When it comes to the wider economy of the Republic, however, the presence of these multinationals for tax purposes does not translate into hundreds of thousands of jobs in Ireland itself. The reason is a subject hotly contested by the multinationals, and it relates to where the ‘work’ is actually done and where the money is earned.

For the avoidance of doubt, Facts4EU.Org is quite sure that all the multinationals involved are in full compliance with all the tax laws in the jurisdictions in which they operate.

And finally for the Irish....

Ireland is now a net contributor to the EU. The Irish now pay in more than they get back, after years of being on the receiving end of money paid in by the British taxpayer. It will be interesting to see how the Irish people react once they know that they are now subsidising other EU countries.

And when the EU Commission get their way and stop the Republic from having a highly competitive corporation tax rate, the Big Tech companies will look to go elsewhere and tax revenues will start to reduce, meaning increased taxes for the citizens of the Republic of Ireland.

We must get reports like this out there

Reports like the one above take far longer to research, write and produce than many people realise. If they were easy, readers would see other organisations also producing these daily.

However, there’s little point in the Facts4EU.Org team working long hours, seven days-a-week, if we lack the resources to promote them effectively – to the public, to MPs, and to the media. This is where you come in, dear reader.

Facts4EU.Org needs you today

We are a 'not for profit' team (we make a loss) and any payment goes towards the actual work, not plush London offices, lunch or taxi expenses, or other luxuries of some organisations.

We badly need more of our thousands of readers to become members, to support this work. Could this be you, today? It's quick and easy, we give you a choice of two highly secure payment providers, and we do NOT ask you for further support if you pay once. We just hope you keep supporting us. Your membership stays anonymous unless you tell us otherwise.

Please don't assume that other people will keep us going - we don't receive enough to survive and we need your help today. Could you help us? We rely 100% on public contributions from readers like you.

If you believe in a fully-free, independent, and sovereign United Kingdom, please join now by clicking on one of the links below or you can use our Support page here. You will receive a personal, friendly ‘thank you’ from a member of our team within 24 hours. Thank you.

[ Sources: EU Commission statistics agency (Eurostat) | Bentley Motors ] Politicians and journalists can contact us for details, as ever.

Brexit Facts4EU.Org, Tues 28 Mar 2023

Click here to go to our news headlines

Please scroll down to COMMENT on the above article.

And don't forget to actually post your message after you have previewed it!

Since before the EU Referendum, Brexit Facts4EU.Org

has been the most prolific researcher and publisher of Brexit facts in the world.

Supported by MPs, MEPs, & other groups, our work has impact.

We think facts matter. Please donate today, so that we can continue to ensure a clean Brexit is finally delivered.

Paypal Users Only - Choose amount first

Quick One-off

Monthly

Something to say about this? Scroll down for reader comments