Protectionist EU set to be left behind by global Brexit Britain, says City group

Post-Brexit City & financial services - at the gateway of its greatest era of prosperity and global leadership

© Brexit Facts4EU.Org 2021

"Now, more than ever, the City needs the foresight and drive that made its markets great"

Today we are pleased to present a guest article by a highly-respected figure in the world of finance: Professor Daniel Hodson, Chairman of The CityUnited Project.

In his article below, Professor Hodson argues that the EU's apparent desire to retreat behind a protectionist wall in fact presents the UK's dominant and innovative City and financial services sector with significant opportunities.

A Brexit Facts4EU.Org guest article

The post-Brexit City is at the gateway of its greatest era of prosperity and global leadership

By Professor Daniel Hodson, Chairman, CityUnited Project

The City establishment is lacking in vision. Now, more than ever, it needs the foresight and drive that made its markets great. The post-Brexit City and the UK financial services industry stand at the gateway of their greatest era of prosperity and global leadership.

Yet one strange and challenging problem mars this golden opportunity: the equivocal and short-sighted positioning of much of its establishment, notably the City Corporation and the large multinational institutions and their creature spokesperson, The CityUK.

There is an alarming absence of vision and certainly of media presence; instead an apparent retrospective desire to cling as far as possible to the EU's regulatory shirt tails, instead of embracing the opportunity to set, in partnership with other great financial service centres, the gold standard for safe and attractive markets.

Into this void has now stepped the frontline practitioner-led CityUnited Project with a clear objective of ensuring that the City and the UK financial services industry as a whole realises its global opportunity, to serve the world, supported by a fair and competitive regulatory and taxation framework and the highest skills possible.

Debunking the EU "equivalence" arguments

Principal amongst its immediate targets will be to debunk the argument that an EU agreement on so called “equivalence”, that is sufficiently similar regulation for the EU to allow British firms access to its markets, is a vital priority. It is unequivocally not – and for two very simple reasons:

- Such an agreement would effectively undermine any of the radical but desirable changes in regulation needed for continued global financial service leadership

- In any event EU equivalence decisions are highly political and can be renounced at no effective notice

These reasons mean that such an agreement would not be worth the paper on which it was written. The scar tissue left from the EU’s overhasty triggering of Article 16 of the Northern Ireland Protocol shows just how such “political” opportunities may be handled by the EU.

Nevertheless, the CityUnited Project could have an important ally in the UK in the City regulatory community given the Governor of the Bank of England Andrew Bailey’s recent seminal speech embracing regulatory independence and proactive development within a global institutional framework. His exceptional clarity is notably different from The CityUK’s stated priority “to urge the EU to work with the UK on outstanding equivalence decisions” and from the Barclays CEO Jes Staley’s widely reported recent endorsement of the City’s global aspirations, but telling the BBC “I wouldn't burn one piece of regulation.”

The UK is adapting fast

The truth is that the City has, in its own inimitable away, adapted quickly to its changed post-Brexit circumstances, and seized many of the opportunities that have been presented.

EU locations have been established as insurance and migration has been minimal. The business lost to the Continent has been anticipated – EU share trading and EU-centric carbon futures trading, for instance.

And as the EU has built a protectionist wall round its existing financial service operations, City innovation – honed by the hugely successful Eurodollar market of yesteryear and other similar initiatives – will continue to establish increasingly deep and liquid parallel globally accessible markets, such as the immediate arrival of “dark pool”, ie off exchange, trading in EU securities.

The City and the financial services industry can contribute significantly to UK PLC

So the CityUnited Project believes that the City, and the UK financial services industry generally, should be a massive contributor to future British prosperity and political influence, building on its 1.5m employment and its colossal current annual tax contribution of £76bn.

Shaking off their EU shackles, and in collaboration with other great financial centres, they can continue to take a lead role in the ongoing development of a sound and proportionate framework for global markets and their regulation. Their role in stimulating and supporting international trade and investment, building on British fintech hegemony, will serve British exports and political objectives in all the UK’s major spheres of influence.

At home, and supported by an accommodating tax regime and skilled immigration policy, they can help stimulate employment, not least in supporting regional development and closer Union ties, through Special Economic Zones and with particular attention to the prospects of Edinburgh and Belfast.

The CityUnited Project pictures the City of London, together with the UK’s ancillary financial services industry, as a rapidly changing global asset, but one that has yet fully to appreciate, exploit and celebrate its newfound freedom. Its diverse, constantly evolving markets and services need that freedom to prosper and thrive in the years to come, for the benefit of participants and customers throughout the Continent of Europe and the rest of the world.

The City of 2030 will be a very different place from that which woke up, amazed and startled, but as always aware of the opportunities of change, on the morning of 24th June 2016.

- By Professor Daniel Hodson, 15 Feb 2021

About the author and The CityUnited Project

Professor Daniel Hodson is Chairman of the CityUnited Project, Vice Chairman of the Independent Business Network, and Chairman of The City for Britain. He was formerly CEO of LIFFE, Deputy CEO of Nationwide Building Society, a director of the London Clearing House, and is Gresham Professor of Commerce.

The vision of the City United Project is a global City and UK financial services industry, serving the world and supported by a fair and competitive regulatory and taxation framework and the highest skills possible.

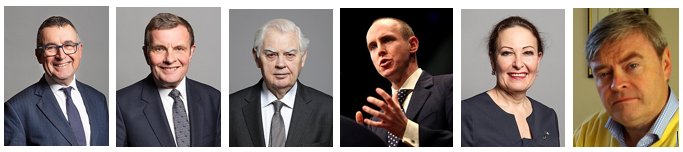

Supported by leading politicians, Sir Bernard Jenkin MP, David Jones MP, Lord (Norman) Lamont, Lord (Daniel) Hannan, Anne-Marie Morris MP, and former MEP David Campbell Bannerman, it speaks positively and authoritatively for the industry’s future opportunities and rebuts the current round of negative and under-informed stories about EU share trading and loss of access (due to lack of “equivalence”) to EU markets.

The CityUnited Project's Political Advisory Board: Sir Bernard Jenkin MP (Chair), David Jones MP, Lord (Norman) Lamont, Lord (Daniel) Hannan, Anne-Marie Morris MP, and former MEP David Campbell Bannerman

The group will build on and promote the City’s outstanding track record of product development and innovation, particularly in Fintech. It also seeks to show how the industry can enhance employment in the City and in regions and financial centres such as Belfast and Edinburgh and throughout the Union.

‘The CityUnited Project’ says that the Government must now accept that the EU has in effect denied normal cooperation with the City and its associated financial services, which represents one of the powerhouse engines relied on by the Eurozone itself, as well as by the wider European economy.

Together the new group is responding with initiatives, policies, and recommendations for the Government. Part of its aim is to combat and negate the EU’s actions. It will also be promoting bold new initiatives to exploit the UK’s expertise in financial services and to re-set the agenda for global financial services.

Observations

A positive article by a positive post-Brexit group

It is becoming clearer by the day that the opportunities for the UK's powerful City and financial services sector lie in our global penetration. If the EU wishes to continue to put up its protectionist walls, it's likely to see the rest of the world less and less attracted to its revisionist and outdated attitudes.

The UK will stand out as the place to do business in our time zone.

We would love to keep the team together, working for you

We are most grateful to readers who have donated this year, but we badly need more readers to do the same. 10 readers donating £500 per month, or 50 readers donating £100 per month, or 1000 readers donating £5 per month - on top of the one-off donations and monthly donations we currently receive, this would just about keep us going.

We have far more to do in researching, publishing, campaigning and lobbying Parliament than we have in terms of the financial resources to fulfil these tasks. We rely 100% on public donations from readers like you. Unlike the Remain/Rejoin camp, we do not have foreign billionaires to subsidise our work.

If you believe in a fully-free, independent, and sovereign United Kingdom, and want to see the full benefits of Brexit being delivered, please make a donation now. It’s quick, secure, and confidential, and you can use one of the links below or you can use our Donations page here. You will receive a personal, friendly ‘thank you’ from a member of our team within 24 hours. Thank you so much if you can help to keep us going.

[ Sources: Professor Daniel Hodson ] Politicians and journalists can contact us for details, as ever.

Brexit Facts4EU.Org, Wed 17 Feb 2021

Click here to go to our news headlines

Please scroll down to COMMENT on the above article.

And don't forget to actually post your message after you have previewed it!

Since before the EU Referendum, Brexit Facts4EU.Org

has been the most prolific researcher and publisher of Brexit facts in the world.

Supported by MPs, MEPs, & other groups, our work has impact.

We think facts matter. Please donate today, so that we can continue to ensure a clean Brexit is finally delivered.

Paypal Users Only - Choose amount first

Quick One-off

Monthly

Something to say about this? Scroll down for reader comments