Exclusive: Rachel’s lies are TWICE as bad as we all thought

Buried figures show she has to borrow an eye-watering £1.3 TRILLION

Will the markets even want to lend to her?

Montage © Facts4EU.Org 2025

Rachel’s coming debt mountain in layman’s terms - Would she rather be fired than face it?

An explosive, damning exposé, doubling the pressure on the Chancellor to go

Researched and written by Brexit Facts4EU with comments from the Rt Hon Sir John Redwood

Our report makes the front page of the Daily Telegraph

We will provide details tomorrow

For the first time we can reveal exclusively the full extent of the two ways the Chancellor misled the House of Commons and the public last week. And the second way doubles the amount of borrowing Rachel Reeves talked about last week. When MPs read this report, the growing stream of calls for her to go will surely become a tidal wave.

Our analysis of the HM Treasury’s 152-page Red Book – the detail that backs her Budget speech – has uncovered a double-whammy of borrowing which has effectively been masked by Ms Reeves. In layman’s terms we can show just what her Budget will do to all of us and the potentially huge problems the country may face when asking the rest of the world to lend us so much extra money.

Firstly, how much are we talking about?

For the first time, we reveal the truth behind the two parts of Rachel’s multi-billion pound borrowing spree. One of these simply has not been exposed – until now.

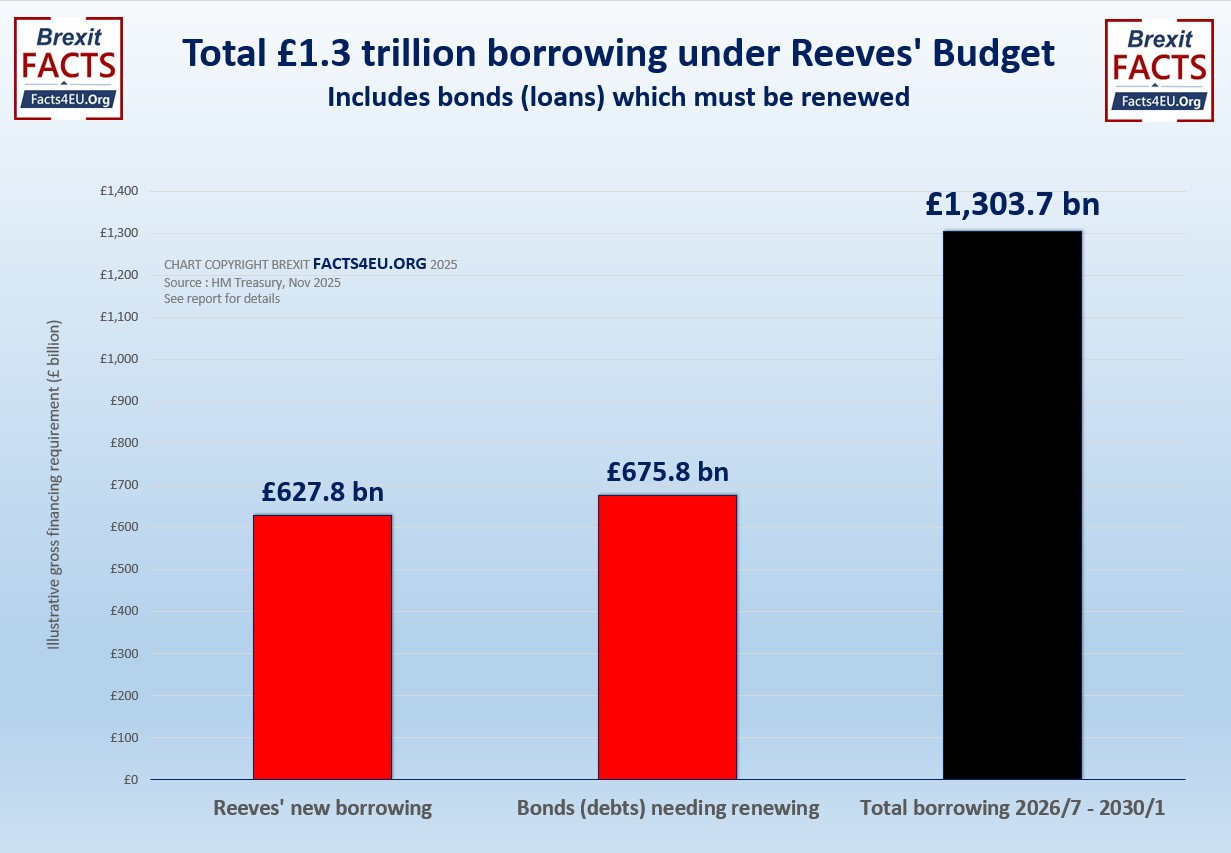

Below we show the amount of new borrowing Rachel Reeves talked about in her Budget. Next to this is the borrowing in the form of loans (‘bonds’) which have to be renewed. Then the scary total of the two.

Breakdown of Rachel Reeves' total borrowings, Budget 2025

Note: Total excludes total debt to date but includes existing bond levels

© Brexit Facts4EU.Org 2025 - click to enlarge

[Source(s) :HM Treasury Nov 2025 ]

Rachel’s ‘misleading’ of MPs and the public

So what did the Chancellor say about our debt last week?

“Today’s Budget builds on the choices that we have made since last July… to cut debt and borrowing.”

“I said I would cut debt and borrowing, and I meant it”

“Today, 1 in every £10 that government spends is on debt interest… not on paying down that debt, but just on paying the interest. My fiscal rules will get borrowing down while supporting investment”

“Madame Deputy Speaker, I said we would cut the debt and we are”

“Those are my choices: Not austerity; not reckless borrowing; but cutting the debt”

- The Rt Hon Rachel Reeves MP, 26 Nov 2025

So, did Rachel Reeves “cut debt and borrowing” or not? We asked Sir John Redwood to comment

The Facts4EU chart above, based on official figures, is scary. Far from bringing the current elevated levels of state debt down, it carries on rising. When you take into account how much of the existing debt falls due for repayment it means very high levels of new borrowing on a sustained basis over five years.

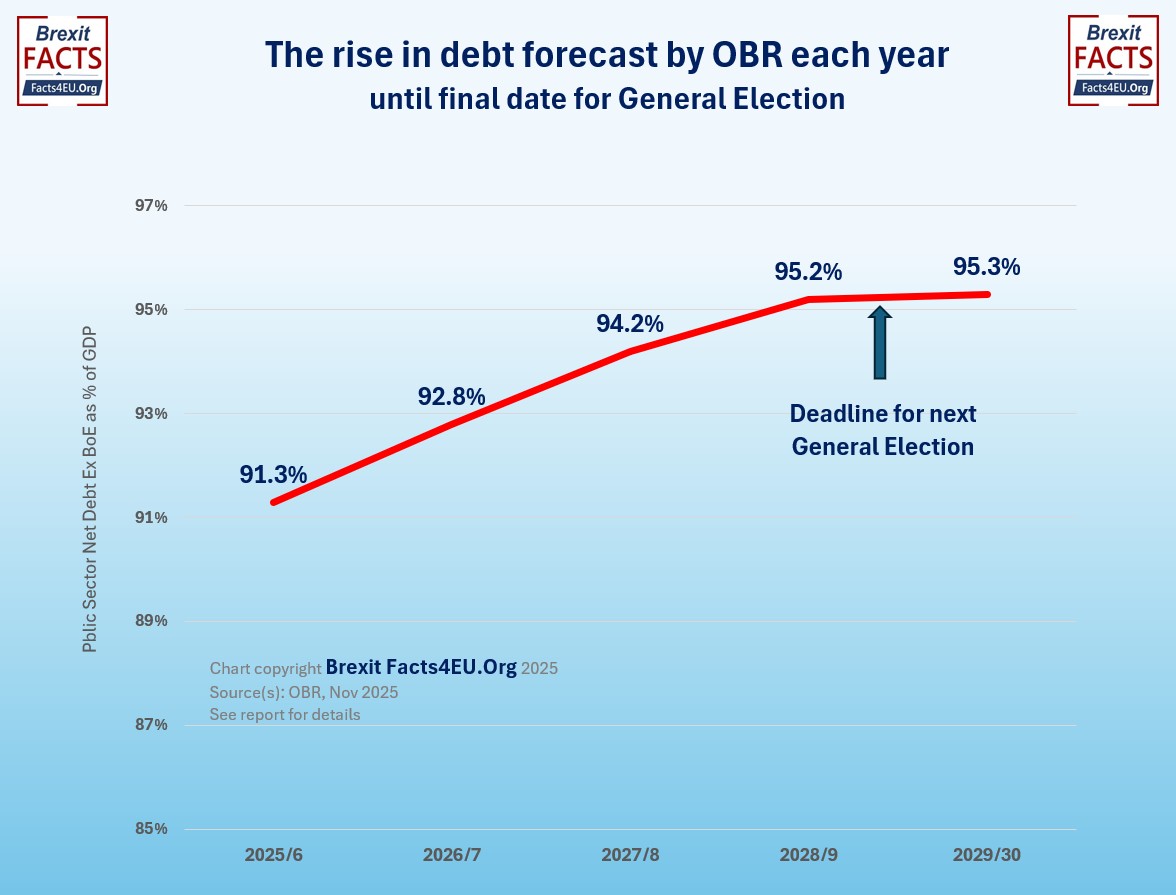

Looking at debt as a proportion of GDP is a common government way to play down the colossal cash sums they are borrowing, but even on this basis debt is still going up. So why does the Chancellor say she is cutting the debt?

Far from lifting the spectre of higher borrowing rates and reluctant lenders, her big spending boost just puts off further tackling the necessary task of getting debt and therefore interest charges under control. All of us and our children and grandchildren will be paying for Reeves' debts for years to come.

Net debt as a percentage of GDP - Official 5-year forecast

The Chancellor's own figures from the OBR show debt rising every year

© Brexit Facts4EU.Org 2025 - click to enlarge

[Source(s) : OBR, Nov 2025 ]

The truth versus the lies, about how much it will cost us to keep this Government in power

Rachel Reeves is already having to deal with the accusations she misled the House and the public about the non-existent £20-30bn ‘black hole’ in the public accounts - and she raised taxes again using this as an excuse. The Office for Budget Responsibility is quite explicit she knew this black hole did not exist and has produced the evidence to prove it.

The impression left with the public was that borrowing was going down. This is not the case for two reasons. The UK’s gross financing requirement has two parts:

- Covering the extra bills we are incurring due to increased spending, and

- Renewing our loans (called government bonds, or ‘gilts’)

It’s this second part which has not been discussed, yet it’s as large as the first part and it could rise up to bite the Government when they try to go to the markets to renew these loans. There is then one further problem with how Ms Reeves presented her case over recent weeks and in the Budget speech, which we will come to further down.

We gave this to the Daily Telegraph yesterday as an exclusive and it made the front page.

It's a shame we will soon have to close our doors, after 10 years.

We rely wholly on patriotic members of the public to survive. Please donate today if you would like to continue reading us tomorrow, next week, and the weeks after.

Don't leave this to someone else. You are that 'someone else'.

Going to see your bank manager...

Imagine you have a bank loan and today’s the day you have to go and see your bank manager to repay it. You go into his or her office and slap the – say, £20bn – on the desk.

Then you explain that you need a new bank loan, this time for double the amount: £40bn. After some negotiation the manager agrees, but the interest rate will have to be higher. Up from 4.5 to 4.75%.

This scenario plays out many times a year over the next five years. In the end it reaches a total of £1.3 trillion pounds.

At what point do you think the manager might start to question your finances, and ask why you are not cutting costs so that you don’t need these increasingly more expensive loans? After all, the manager points out, you are now paying more in interest each year than you spend on your children’s health.

Maybe one day the manager takes your money to repay the latest loan and says he is not able to give you another one. “Even Greece is now a better risk than you are.” You have to start getting loans from increasingly more expensive banks, because they know you are running short of other providers willing to make you an offer. Each time the interest rate goes up.

The Rt Hon Sir John Redwood gives his comments on this debt mountain

Rachel Reeves is building a debt mountain whilst claiming to bring the debt down. She wants to add a staggering £628bn to the state debt over the next five years, as if the £3 trillion the government has already borrowed was not enough.

She only brings in some tax rises at the end of the period to pretend late in the day to be doing something about her borrowing habits. Who believes those tax rises will take place, as they will be after the next election when Rachel Reeves is unlikely to still be in charge? She obviously thinks it easier to pencil in tax rises for the next government after she has gone than to actually impose them now to stem the borrowing.

Worse still for the bond market that she wants to provide her with all the money, is her need to borrow yet another £675bn to be able to replace existing debts as they fall due. It is like watching someone who wants to go on a spending spree aim to take out a large overdraft, only to find they also need a pile of cash to repay the mortgage they already have when it expires.

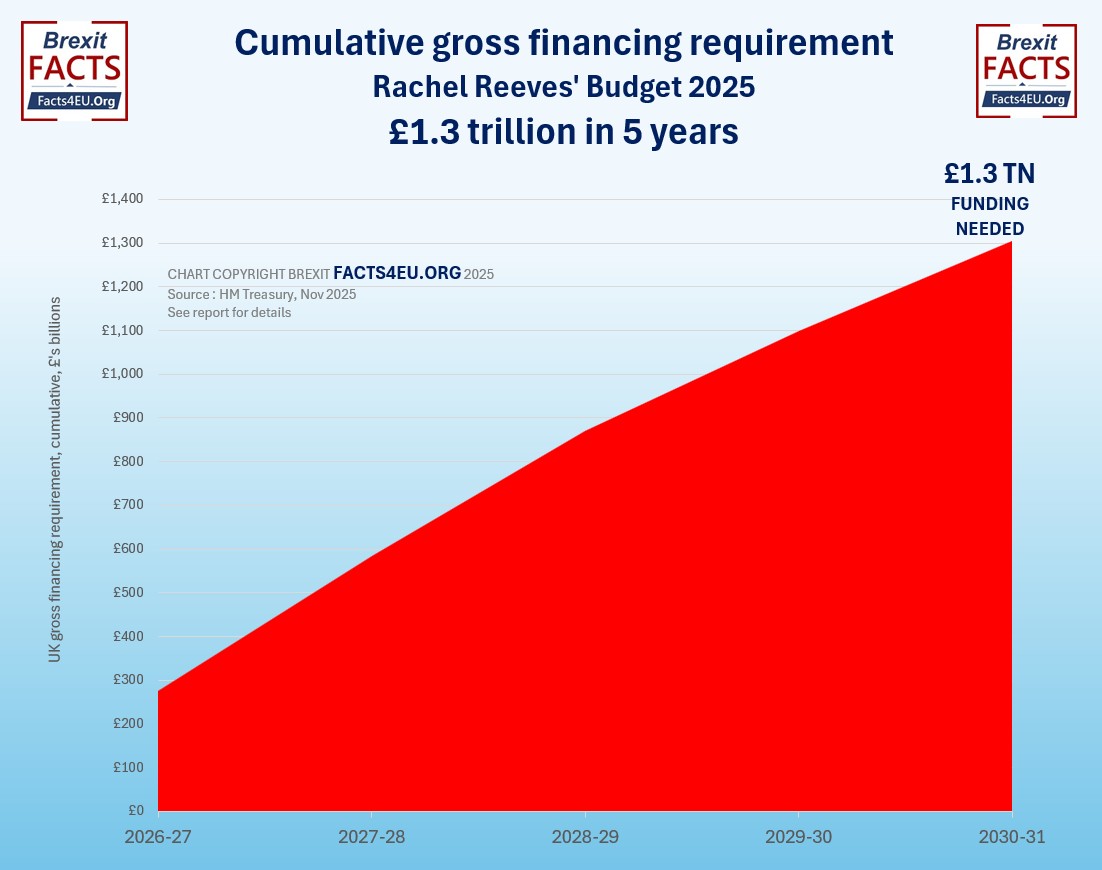

Below is the cumulative total of the two of these for the next five years, as defined by HM Treasury.

The UK’s 5-year financing requirement, 2025/26 – 2030/31, Budget 2025

Cumulative in £’s billion, in addition to existing £2.9tn debt

© Brexit Facts4EU.Org 2025 - click to enlarge

[Source(s) :HM Treasury Nov 2025 ]

The above are the official figures for what Rachel Reeves has to find to keep the country solvent.

Asking the bond markets to find another £1,300 billion (or £1.3 trillion) is asking a lot. The Bank of England is a seller of bonds, no longer a buyer. It is now making it more difficult for the government to lay its hands on cheap cash by selling bonds at the same time as the government is trying to raise money. The pension funds which over the years have bought billions of government debt are maturing. The ones that bought many more bonds than they can afford are having to rein in their bond buying habits after making some big losses on them. It’s going to get tougher for the government to borrow so much money than it was in 2020 to pay the Covid lockdown bills. Then state debt was lower, and the Bank and the pension funds were keen buyers.

Far from liberating herself from the discipline of the bond market, she needs to go more carefully. Far from bringing debt down she envisages a huge expansion and a need for major refinancing. She is right to say spending more than £100bn each year on interest on debt is unacceptable. So why then is she planning to put that bill up to £125bn or more with all her extra and dearer borrowing? What other taxes will she raise to pay all that extra interest?

The £3.5 trillion of national debt – what does it mean to each of us?

As we have stated above, it is only the new, additional borrowing which will be added to the national debt. Borrowing to replace bonds (‘loans’) is already counted in the total. This extra borrowing of £627.8bn by Rachel Reeves will therefore take the national debt to £3.53 trillion.

To put this into context, this equates to £50,840 for every man, woman, and child in the country.

Rachel Reeves will now take our indebtedness to more than £50,000 per head for the first time.

Final comments from the Rt Hon Sir John Redwood

Rachel Reeves is on the political rack. She is being accused of dishonesty over the OBR forecasts, which showed she did not face a large black hole as she implied. She and her advisers have failed so far to institute a leak enquiry to see how so many apparently well informed leaks about the budget got into the media and newspapers ahead of the event. She is being criticised for herself holding an emergency news conference to tell the nation one morning that things were so dire she needed to raise taxes. She is being criticised by the hospitality and retail sector for promising lower rates bills when she cancelled their discounts and allowed the rateable values for many to go up.

Now Facts4EU point out that far from reducing the debt as she implied, she will be boosting it massively and having to refinance very large loans as they fall due for a repayment she cannot afford. This is no way to run a major economy. It is bad for business, bad for jobs, and bad for confidence. Above all it is bad for all the people who now have to pay the bigger bills for an ever expanding state that does not know how to nurture growth and keep its promises.

Observations

In this report we have revealed a ticking time-bomb in the Chancellor’s Budget. While many articles have been written in recent days about the Budget’s predicted rise in overall national debt (to £3.5 trillion), everyone has missed this explosive element contained deep in HM Treasury’s figures underlying Rachel Reeves’ budget.

The simple fact is that the embattled Chancellor has to go to the markets, cap in hand, and attempt to borrow £1.3 trillion in the next five years alone.

Our report makes the front page of the Daily Telegraph

Yesterday we gave this report as an exclusive to the Daily Telegraph, where it made the front page twice. Camilla Tominey wrote an excellent piece, as well as producing a highly entertaining podcast with Tim Stanley. We will provide details tomorrow, so that readers can see these for themselves.

Our Chairman’s comments:

“Let’s face it, any person in the street listening to Rachel Reeves making her Budget speech would have come away with the impression she was cutting borrowing and the national debt.

“Her Budget does no such thing. She as good as lied about her infamous ‘black hole’. On top of that, this exposé today from Facts4EU reveals the Budget will have her going to the markets to raise £1.3 TRILLION pounds. Around half of this is additional borrowing and half is needed to replace loans (bonds) coming to maturity. Now that’s something she kept very quiet about.

“How are the markets going to react to a Chancellor spending more and more, with no signs of any restraint, expecting them to double the amount they have been lending? We can see no sign in the accounts of the huge potential cost of the impending increase in interest rates being charged for such a vast sum. Indeed, there is even a question mark over whether the markets will be able to sustain such requests.

“Sir Keir’s fortunes are now inextricably linked with those of Rachel Reeves, with No.10 having backed her at the weekend. We wonder how he’ll feel if he’s shown this report.”

Please, please help us to carry on our vital work in defence of independence, sovereignty, democracy and freedom by donating today. Thank you.

[ Sources: HM Treasury | ONS | OBR ] Politicians and journalists can contact us for details, as ever.

Brexit Facts4EU.Org, Wed 03 Dec 2025

Click here to go to our news headlines

Please scroll down to COMMENT on the above article.

And don't forget actually to post your message after you have previewed it!

Since before the EU Referendum, Brexit Facts4EU.Org

has been the most prolific researcher and publisher of Brexit facts in the world.

Supported by MPs, MEPs, & other groups, our work has impact.

We think facts matter. Please donate today, so that we can continue to ensure a clean Brexit is finally delivered.

Paypal Users Only - Choose amount first

Quick One-off

Monthly

Something to say about this? Scroll down for reader comments