EXCL: “Net Zero, greatest act of financial self-harm ever imposed, gets worse as Starmer now aligns us with EU”

Reform UK's Deputy Leader, Richard Tice MP, lays into Labour's 'double whammy' as Government confirms talks underway

Montage © Facts4EU.Org 2026

Sir John Redwood calls for MPs to act now to stop further calamity for British industry

If a government set out to destroy some industries, severely damage others, halt growth, and de-industrialise its country while at the same time putting up consumer prices, you would be hard-pressed to come up with two schemes more likely to achieve these objectives than those we are about to describe.

A Facts4EU report, with our friends at Stand for Our Sovereignty, and in association with GB News

These are the result of the Net Zero obsession. The latest major iteration began in the dying moments of Theresa May’s disastrous reign when she rushed through a Statutory Instrument to amend the latest of the Blair/Brown government’s two Climate Change Acts and impose an absolute ban on greenhouse gas emissions by 2050.

More recently this has been taken up with a vengeance by the new Labour government and in particular the Secretary of State for Net Zero, Ed Miliband.

New net zero talks said to have started with EU last week – No word from the Government

Originally we were concerned about the Government’s plans, announced in December, to introduce its new CBAM (Carbon Border Adjustment Mechanism) on 01 January next year. As we explain in more detail below, this involves taxing certain products imported from overseas which have a high carbon content in their production.

This has pluses and minuses, the minus being that some imported goods will suddenly cost a lot more, pushing up prices in the UK.

Then, we learnt from Brussels – but NOT from No.10 or from Ed Miliband – that talks were planned to have started last week to align the UK with the two types of Net Zero taxation. This information comes from none other that the EU’s Commissar for these things – the Ed Miliband of Brussels. He is a Dutchman by the name of Wopke Hoekstra, and is seemingly a paid-up member of the globalist movement.

The Wopke Hoekstra Interview

Here is Mijneer Hoekstra in an interview with Reuters on 14 January:

“We’re going to start the negotiations next week. The UK has been doing, over the years and across the political aisle, a great job in terms of climate action. So, in my view, this is imminently doable.”

- Wopke Hoekstra, 14 Jan 2026

He went on to tell his interviewer that he was ready to have “speedy” talks. This ties in with the fact that the EU introduced their own CBAM (tariff border for carbon) on 01 January this year. The EU’s CBAM applies tariffs onto goods imported into the EU, including those from the UK.

What did the UK Government say about this?

After interviewing Mijneer Hoekstra, it’s not surprising that Reuters contacted the Government. Apparently a UK government spokesperson “declined to comment on when negotiations would launch”.

All they would say was:

“We are delivering on our commitment to secure a carbon linking agreement with the EU as soon as possible.”

- Government spokesman, 16 Sept 2026

EXCLUSIVE: Independence Facts4EU can reveal a different story

Facts4EU made our own enquiries for this report, yesterday 28 January.

A well-placed Government source told us that "talks are in fact ongoing” between the UK Government and the EU Commission. They are expected to continue for some time and the Government expects a resolution in time for the next Summit.

This statement, albeit unattributable, completely vindicates this report and proves we were right to pursue the story and bring the facts to the attention of the public.

Richard Tice MP, Deputy Leader of Reform UK commented exclusively

to Independence Facts4EU, Stand for Our Sovereignty, and GB News.

“I’ve said it before and I’ll say it again: Net Zero is the greatest act of financial self-harm ever imposed on a nation by its own Government. This latest news exposed by Facts4EU and GB News just shows the Government doesn’t want you to know about what they’re doing.

“Not only that, but this is all part of their continued alignment with their friends in the EU. We should be doing everything possible to help British industry. Instead Miliband and friends are doubling down by holding talks on matching the EU’s carbon taxes, making us all worse off. It’s ideological and we’re going to rip it all up.”

- Richard Tice MP, Deputy Leader of Reform UK – 28 January 2026

Our own views on this

Originally it had been assumed that the UK would be exempted, like Switzerland, but no. We must not forget that this is Brexit Britain they are talking about, which must be punished at every opportunity, it seems.

Part of the assumption on the British part was that the Government had already introduced a carbon emissions tax on products made in the UK, unlike a great many countries. Now these products will be taxed a second time if they are exported to the EU.

Caveat: It is of course possible that the Government has slipped out this news quietly. If it has, we haven’t been able to find it and it has certainly not been prominent in any way.

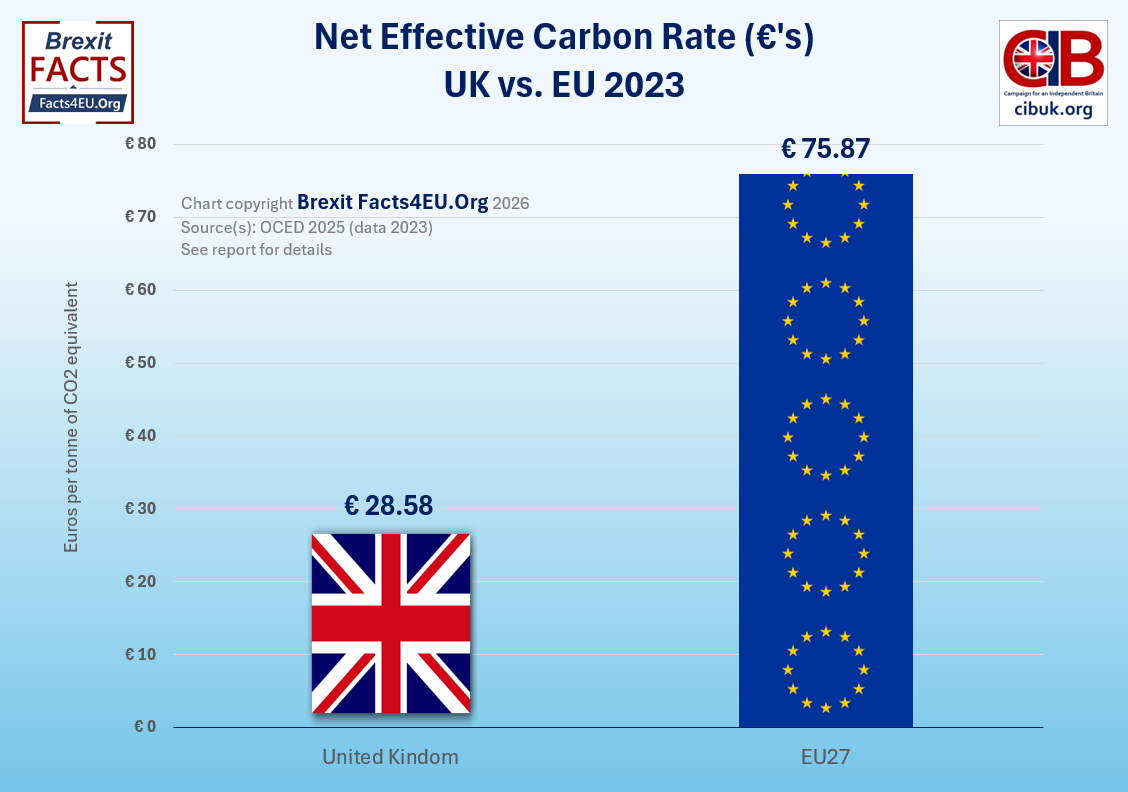

How the UK compares with the EU, on average

It is important to state up front that it is very difficult to find accurate comparisons of carbon taxing of all kinds between countries. This is because the whole area is complex, with levies being applied in different ways, on different products, and also because of the problems of measuring emissions involved in producing goods.

Below we show one such comparison, produced by the OECD late last year in an authoritative report. The OECD produces this report every two years, and we have extracted the information below from that.

OECD 2025 Report showing Net Effective Carbon Rates in Euros

Comparing the UK with the EU

© Brexit Facts4EU.Org 2026 - click to enlarge

[Source(s) : OECD ]

The above chart clearly shows the overall difference between the net carbon costs of the UK and the EU. Should we have to align, this will make a serious difference to the UK’s costs in several sectors.

The EU’s net effective carbon rates are on average almost three times the cost of the UK’s.

Richard Tice MP, Deputy Leader of Reform UK commented to us further

“The major briefing paper published by the highly respected Institute of Economic Affairs a couple of weeks ago showed that the true cost of Ed Miliband’s madness will be even higher than the official estimates of 7.6 TRILLION pounds.

“Forget the disproven claims of cheap energy, scrapping Net Stupid Zero could save households up to £1,000 per year and save what’s left of British industry.”

- Richard Tice MP, Deputy Leader of Reform UK – 28 January 2026

Net Zero versus the state of the economy, the cost of living crisis, and common sense

Both the Official Opposition, (the Conservatives), and the Party leading in the polls, (Reform UK), have made statements saying that although it is desirable to reduce pollution, the economic circumstances dictate it is highly desirable to row back on Net Zero commitments. This is falling on deaf ears in the Government.

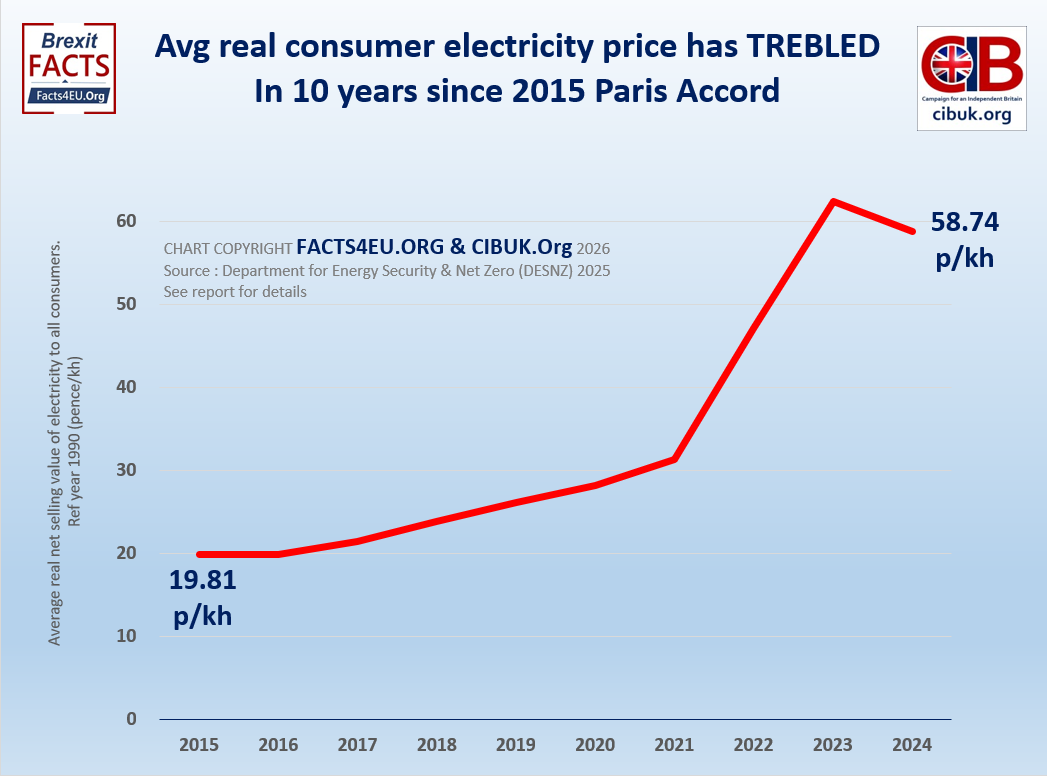

Facts4EU has analysed the latest figures from Ed Miliband’s Department for Energy Security and Net Zero (DESNZ) and can bring GB News readers the following, shocking charts. They show the huge increases in real terms in:

- The cost of electricity for households, and

- The cost of the electricity fuel price for the industrial sector

These have occurred in the 10 years since the 2015 Paris Accords. We must stress that these increases are stated after the effect of inflation and are real terms increases.

A man who has been consistent on this

Here is a man who has been wholly consistent for a very considerable time on the threats to the fabric of the United Kingdom economy represented by Net Zero plans. We asked him to explain what these charts really show.

The Rt Hon Sir John Redwood gives to Facts4EU, Stand for Our Sovereignty, and GB News

his exclusive thoughts on the double whammy for industry

“The extra cost of the carbon tax next year added to the extra cost of imports attracting the carbon border tax will be a double blow to UK industry already badly weakened by high taxes and policies designed to cut their use of fossil fuels when the overseas competitors go ahead using more cheaper gas and coal. The EU re-set means aligning us with some of the highest tax rates on industry worldwide. The US with no carbon taxes in most places, and China with lower ones, will be loving this further self harm by the UK. Worse still is the PM will probably agree we have to pay the EU for the privilege of adopting their anti industry schemes.”

- The Rt Hon Sir John Redwood – 28 January 2026

1. The cost of electricity for households

© Brexit Facts4EU.Org 2026 - click to enlarge

[Source(s) : DESNZ]

2. The cost of the electricity fuel price for the industrial sector

For industry the situation does not look quite so bad at first sight, but in fact a doubling of the cost for any business is sufficiently disastrous as to put it out of business.

© Brexit Facts4EU.Org 2026 - click to enlarge

[Source(s) : DESNZ]

Who would inform you of important news like this, if we were forced to close?

Please help to keep us going.

If more patriotic members of the public don't donate, we will not survive, after 10 hard years.

Please donate today if you would like to continue reading us tomorrow, next week, and the weeks after.

Don't leave this to someone else. You are that 'someone else'.

The rationale behind taxing imported, high carbon products

There is of course a rationale involved in taxing imported concrete, for example. If British concrete is having taxes applied to it under this Government's ‘Emissions Trading Scheme’ (ETS), then imported products should have to have similar taxes (or tariffs) applied to them, in order to create a fair, competitive market.

The question is whether British industry should have to face taxes generated in the UK, when it is already struggling with the excessively high costs of energy it requires.

The Rt Hon Sir John Redwood shares his thoughts on the Emissions Trading Scheme and Carbon Tax

“The UK already imposes a high carbon tax on business, charging them the UK market price for carbon. The government fixed the 2025 price based on 2024 trading levels at £41.84 per tonne of carbon dioxide. Competing countries like the USA and many emerging markets do not impose a similar tax. The current UK market price is £50. The European price from their scheme is currently £77, considerably higher than the UK. The UK government wishes to join the European scheme, so British business has to face a further hike in a tax which is already making them very uncompetitive. Heavy fossil fuel using industries in the UK are losing many factories and investments, forced out by these high levels of additional taxation. The EU re-set will come at a high price, imposing extra costs on business and helping close more factories in the UK.”

- The Rt Hon Sir John Redwood – 28 January 2026

Guess who was the first to come up with all this on the world stage?

Yes, the EU led the World on this. According to the World Bank and the EU itself, the EU was the first to introduce both systems. The EU’s first ETS was in 2005 and the first version of its CBAM on 01 Oct 2023, with its Regulation 2023/956. The EU’s CBAM (for imports) has now been enlarged and this latest launch took place on 01 Jan 2026, at the start of this year.

Ever since these schemes were first launched, more and more products and raw materials have become more expensive, by virtue of industry and commerce having to pay these taxes on an increasing range of products.

The Rt Hon Sir John Redwood on the Carbon Border Adjustment Mechanism

“The UK is planning to introduce an EU style carbon border adjustment mechanism tax or tariff on imports. The scheme will commence with levies on aluminium, cement, fertiliser, hydrogen, iron and steel. The EU scheme covers the same sectors and electricity. This means UK consumers and businesses will have to pay more for their imports unless they can find competitive substitutes from the UK and EU where these industries are already paying carbon taxes domestically. Whilst heavily taxed UK industry will welcome higher taxes on their import competitors the truth is there will not be an early and big switch from imports to home production as the capacity and product is not available. It does mean the many industries that need to use items like cement and steel will have to pay more for their raw materials, leading to dearer construction costs and dearer total costs for manufacturers needing imported raw materials. This will make many users of these products less competitive with further losses of orders and jobs.”

- The Rt Hon Sir John Redwood – 28 January 2026

Finally, a Quick Facts4EU Explainer – all you need to know in under 30 seconds

An Emissions Trading Scheme (ETS) is a tax on businesses that generate greenhouse gases (GHG). They can trade these on a market, to ‘offset’ their emissions, or pay the full tax. This alone can be ruinous for some sectors.

A Carbon Border Adjustment Mechanism (CBAM) is a tax on imports, to account for the GHG involved in producing the goods being imported. The idea is to put foreign companies’ prices on the same basis as home producers. It does of course increase consumer prices for otherwise cheaper products.

Both the ETS and the CBAM are supposed to encourage lower emissions while taking the tax to help pay for the almost ruinous costs of ‘the green transition’, i.e. the massive subsidies Ed Miliband is paying for wind and solar farms.

Observations

Once again we have produced a unique report, this time on a subject destined to cost the country in excess of £7 TRILLION pounds. Not only that, but we secured an admission that talks are indeed underway between the Government and the EU Commission on aligning the carbon taxes being suffered by industry and ultimately the public.

We hope this report has been appreciated by all our readers.

Please, please help us to carry on our vital work in defence of independence, sovereignty, democracy and freedom by donating today. Thank you.

[ Sources: EU Commission | OECD | UK Government | DESNZ (UK Net Zero Dept) | The Rt Hon Sir John Redwood | Richard Tice MP ] Politicians and journalists can contact us for details, as ever.

Brexit Facts4EU.Org, Thurs 29 Jan 2026

Click here to go to our news headlines

Please scroll down to COMMENT on the above article.

And don't forget actually to post your message after you have previewed it!

Since before the EU Referendum, Brexit Facts4EU.Org

has been the most prolific researcher and publisher of Brexit facts in the world.

Supported by MPs, MEPs, & other groups, our work has impact.

We think facts matter. Please donate today, so that we can continue to ensure a clean Brexit is finally delivered.

Paypal Users Only - Choose amount first

Quick One-off

Monthly

Something to say about this? Scroll down for reader comments