BUDGET: UK should now have the most competitive tax rates in Europe – It doesn’t

Freed from the EU empire the UK could be the stand-out country in Europe for low taxes

Montage © Facts4EU.Org 2024

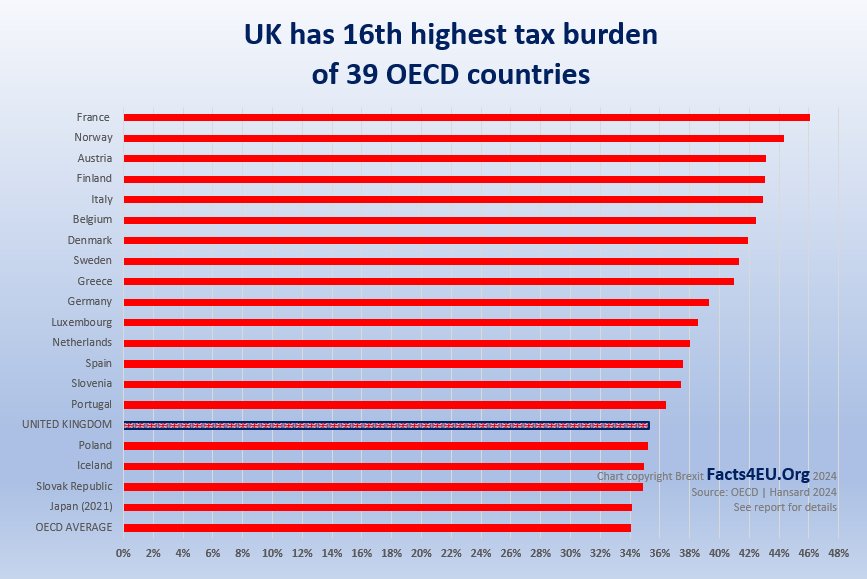

Facts4EU analyses the latest figures from the OECD on the tax burdens across Europe

The full data on the tax burden for each country is always around two years behind. Following Chancellor Jeremy Hunt’s budget yesterday we present the official and latest OECD figures. These do not take into account the Chancellor’s measures announced yesterday.

The full effect of Mr Hunt’s announcements in his budget speech will not be calculated for some time, but the newly-independent UK is hardly the ‘Singapore-on-Thames’ predicted by Rejoiners. In 2022, after leaving the EU, the United Kingdom ranked 16th out of 38 OECD countries in terms of the tax-to-GDP ratio. The UK had a tax-to-GDP ratio of 35.3% compared with the OECD average of 34.0%.Brexit Facts4EU.Org Summary

Tax to GDP ratio according to the OECD

- France : 46.1%

- Norway : 44.3%

- Austria : 43.1%

- Finland : 43.0%

- Italy : 42.9%

- Belgium : 42.4%

- Denmark : 41.9%

- Sweden : 41.3%

- Greece : 41.0%

- Germany : 39.3%

- Luxembourg : 38.6%

- Netherlands : 38.0%

- Spain : 37.5%

- Slovenia : 37.4%

- Portugal : 36.4%

- UNITED KINGDOM : 35.3%

- Poland : 35.2%

- Iceland : 34.9%

- Slovak Republic : 34.8%

- Japan (2021) : 34.1%

- OECD AVERAGE : 34.0%

- Czech Republic : 33.9%

- New Zealand : 33.8%

- Canada : 33.2%

- Hungary : 33.2%

- Israel : 32.9%

- Estonia : 32.8%

- Korea : 32.0%

- Lithuania : 31.9%

- Latvia : 30.2%

- Australia (2021) : 29.5%

- United States : 27.7%

- Switzerland : 27.2%

- Costa Rica : 25.5%

- Chile : 23.9%

- Ireland : 20.9%

- Türkiye : 20.8%

- Colombia : 19.7%

- Mexico : 16.9%

[Source : OECD, accessed 06 Mar 2024.]

© Brexit Facts4EU.Org 2024 - click to enlarge

Tax levels in 2022 – the global picture

Across OECD countries, tax-to-GDP ratios ranged from 16.9% in Mexico to 46.1% in France in 2022. Between 2021 and 2022, the OECD average tax-to-GDP ratio declined from 34.2% to 34.0%. In the UK it rose. Our nearest neighbour in most respects, Ireland, has a tax burden approximately one-third that of the UK. This is now under massive threat from the EU Commission. The UK has no such concern but tax rates are stubbornly high due to Government policy. Among the 21 countries where the tax-to-GDP ratio declined in 2022, the largest fall was in Denmark (5.5%), primarily due to a decline in income tax revenues. The Netherlands, Poland, Sweden, Switzerland and Turkey also recorded declines in their tax-to-GDP ratio. The largest increase in 2022 in Europe was in Norway, where tax revenues rose by 1.9% as a result of exceptional profits in the energy sector.Observations

The simple fact is that we continue to be over-taxed in the UK

Yes, it could be far worse. We could all be living in President Macron’s France where the government trousers nearly 50% of GDP.

Nevertheless, if Brexit Britain is to take advantage of its new-found freedoms in so many areas, then the Budget was an opportunity to slash both personal and corporate taxes.

Chancellor Hunt chose not to do this, based on advice from the Office for Budget Responsibility – a body set up by ex-Chancellor George Osborne which has never come remotely close to giving any Chancellor an accurate forecast of the economic realities.

We must get reports like this out there

Reports like the one above take far longer to research, write and produce than many people realise. If they were easy, readers would see other organisations also producing these daily. However, there’s little point in the Facts4EU.Org team working long hours, seven days-a-week, if we lack the resources to promote them effectively – to the public, to MPs, and to the media. This is where you come in, dear reader.

Facts4EU.Org needs you today

We are a 'not for profit' team (we make a loss) and any payment goes towards the actual work, not plush London offices, lunch or taxi expenses, or other luxuries of some organisations.

We badly need more of our thousands of readers to become members, to support this work. Could this be you, today? It's quick and easy, we give you a choice of two highly secure payment providers, and we do NOT ask you for further support if you pay once. We just hope you keep supporting us. Your membership stays anonymous unless you tell us otherwise.

Please don't assume that other people will keep us going - we don't receive enough to survive and we need your help today. Could you help us? We rely 100% on public contributions from readers like you.

If you believe in a fully-free, independent, and sovereign United Kingdom, please join now by clicking on one of the links below or you can use our Support page here. You will receive a personal, friendly ‘thank you’ from a member of our team within 48 hours. Thank you.

[ Sources: OECD | Hansard ] Politicians and journalists can contact us for details, as ever.

Brexit Facts4EU.Org, Thurs 07 Mar 2024

Click here to go to our news headlines

Please scroll down to COMMENT on the above article.

And don't forget actually to post your message after you have previewed it!

Since before the EU Referendum, Brexit Facts4EU.Org

has been the most prolific researcher and publisher of Brexit facts in the world.

Supported by MPs, MEPs, & other groups, our work has impact.

We think facts matter. Please donate today, so that we can continue to ensure a clean Brexit is finally delivered.

Paypal Users Only - Choose amount first

Quick One-off

Monthly

Something to say about this? Scroll down for reader comments